PROJECTED CASH FLOW PRO

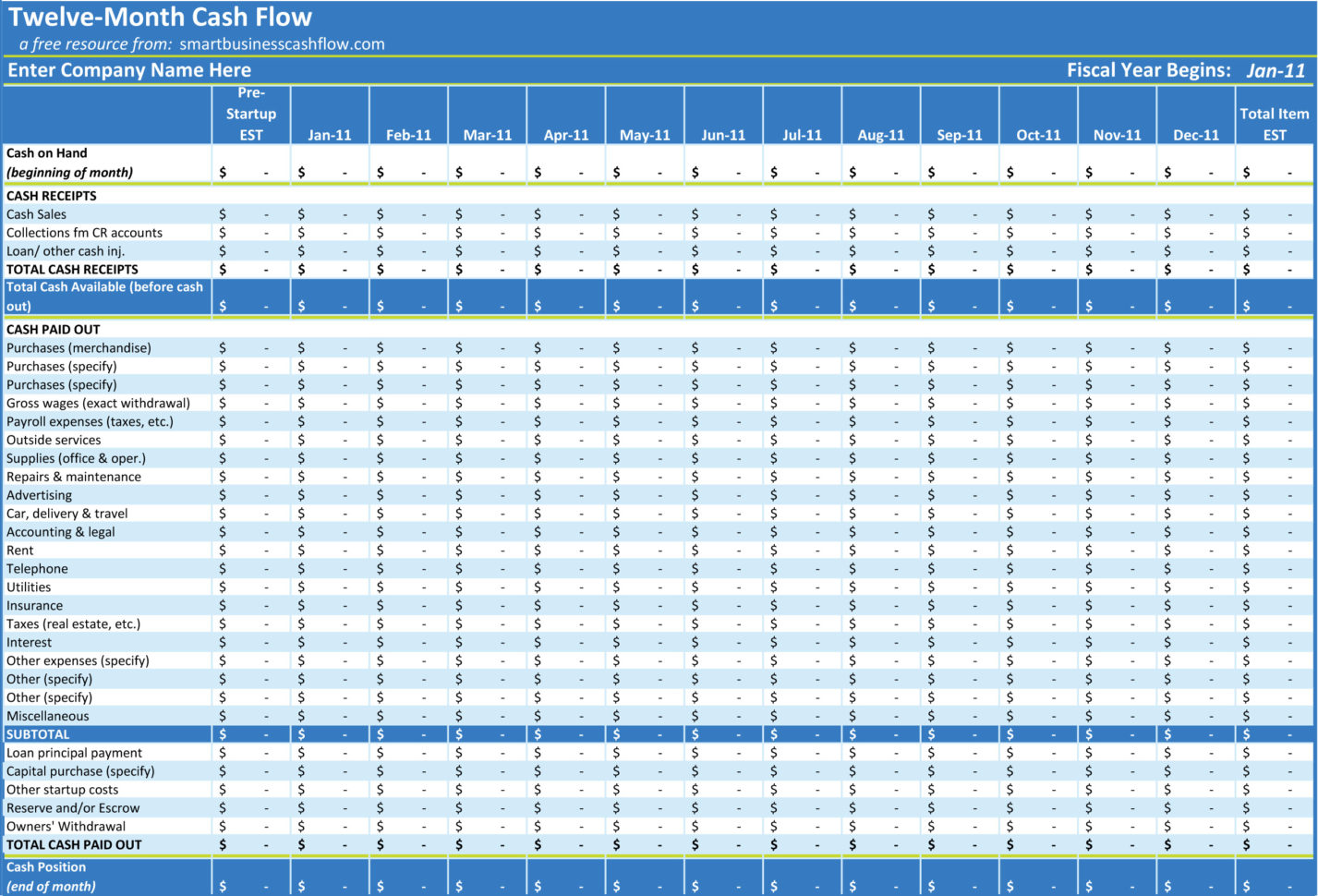

This type of pro forma projection looks at the past financial statements of your business, plus the past financial statements of a business you want to buy. Historical with acquisition pro forma projection It takes into account an injection of cash from an outside source-plus any interest payments you may need to make-and shows how it will affect your business’s financial position. In that case, you can use a financing pro forma projection to make your case. You may be courting investors or trying to convince your business partners of the value of a capital investment or additional financing. Financing or investment pro forma projection That can help you show investors or partners what business finances could look like by the end of the fiscal year. This type of pro forma projection takes into account all of your financials for the fiscal year up until the present time, then adds projected outcomes for the remainder of the year.

While they all fall into the same categories-income statement, balance sheet, and cash flow statement-they differ based on the purpose of the financial forecast. There are four main types of pro forma statements. They can help you make a business plan, create a financial forecast, and even get funding from potential investors or lenders.ĭifferent but related: you can send clients pro forma invoices to let them know how much their order would be if they placed it today. However, pro forma statements are still extremely useful. Using pro forma statements that aren’t marked as such to misrepresent your business to investors, the IRS, or financial institutions can be penalized by the Securities and Exchange Commission). Pro forma statements don’t need to meet the strictest accounting standards, but must be clearly marked as “pro forma” and can’t be used for things like filing taxes. This is because GAAP compliant reports must be based on historical information. Since pro forma statements deal with potential outcomes, they’re not considered GAAP compliant. As in, “What if my business got a $50,000 loan next year?” Your pro forma statements for that scenario would show what your income, account balances, and cash flow would look like with a $50,000 loan. Pro forma statements look like regular statements, except they’re based on what ifs, not real financial results. There are three major pro forma statements: They’re a way for you to test out situations you think may happen in the future to help you make business decisions. When it comes to accounting, pro forma statements are financial reports for your business based on hypothetical scenarios. Pro forma is actually a Latin term meaning “for form” (or today we might say “for the sake of form, as a matter of form”). Made or carried out in a perfunctory manner or as a formalityīased on financial assumptions or projections

According to Merriam-Webster, “pro forma” means:

0 kommentar(er)

0 kommentar(er)